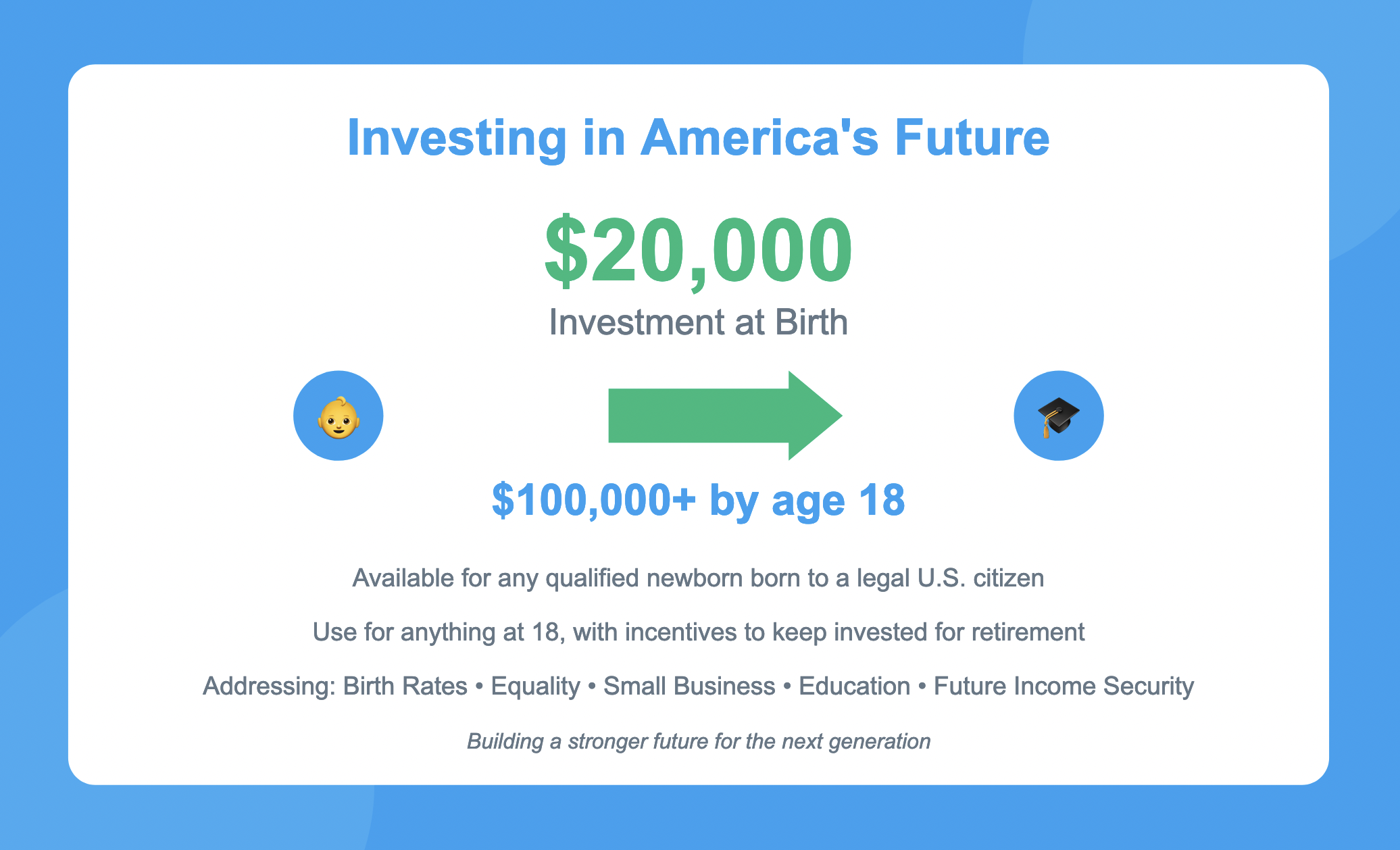

Investing in America’s Future: A $20,000 Investment at Birth Could Change Everything

Investing In America’s Future – SaveAmericaPlan.com – click to visit the website.

Imagine a world where every American child is born with a safety net. A world where, upon taking their first breath, each newborn is handed a key to their future—a $20,000 investment that can grow to over $100,000 by the time they turn 18. This isn’t just a dream; it’s a tangible policy proposal aimed at addressing some of the most significant issues facing America today: inequality, education access, healthcare security, immigration challenges, and the future of Social Security. Here’s how a birth investment like this could change the game for the U.S. and why it’s a policy worth pursuing.

Building Equality from Day One

Inequality is one of the most persistent challenges in the U.S., perpetuating a cycle of poverty that limits opportunity for millions. With a $20,000 investment at birth for every U.S. citizen, we’d be taking a monumental step towards leveling the playing field. This policy would give every child, regardless of background, a significant asset to use for education, starting a business, or even investing in a home. The result? A generation of Americans entering adulthood with more equal footing, and the financial freedom to chase their dreams.

This program wouldn’t just address income inequality but also racial and generational wealth gaps, two critical aspects of systemic inequality in America. By creating an investment in each child, we establish a baseline that helps mitigate the disadvantages often associated with one’s family’s financial background. Ultimately, this policy is a step towards a more equitable society where everyone has a shot at building a secure and prosperous future.

Reinventing Education Financing

The rising cost of education has burdened millions of Americans with debt, limiting their ability to contribute positively to the economy after graduation. With this investment maturing to $100,000 or more by the age of 18, young adults would have substantial resources to pursue higher education or vocational training without incurring significant debt.

Consider what this means for families—students would no longer need to rely heavily on student loans, freeing them from the crushing weight of repayment after graduation. This policy could encourage more young people to pursue higher education or technical training, leading to a more skilled workforce better equipped to meet the demands of a rapidly evolving economy.

Additionally, this approach aligns perfectly with what we know about the value of investing early in a child’s future. The knowledge that a financial foundation awaits them at 18 could motivate students to stay in school, work hard, and pursue their passions without fear of financial barriers. With more people gaining access to quality education, the U.S. can begin to close the educational attainment gap, helping build a stronger and more competitive workforce.

Healthcare Security and Future Income Protection

The proposal also addresses a hidden issue: future healthcare needs. An investment at birth that grows over time could offer a safety net for those unexpected life moments, like a health crisis or job loss. If allowed to roll over into a retirement or healthcare fund, this $100,000 investment could also supplement future Medicare and Social Security benefits, helping reduce the strain on these programs and ensuring that Americans have something extra to fall back on in their later years.

In terms of healthcare specifically, individuals could use this fund to cover costs associated with healthcare expenses, bridging gaps for those who find themselves without adequate insurance. This investment could supplement Medicaid for lower-income citizens or even act as a private safety net for those who need it.

Impact on Immigration and Citizenship

The proposal specifies that the $20,000 investment is for U.S.-born citizens. While on the surface this might seem exclusionary, it also reinforces the value of American citizenship, incentivizing legal immigration pathways and potentially discouraging illegal immigration. This could streamline the immigration process, as more individuals might seek legal residency in order to secure a similar future for their children.

This investment structure could also lead to a stronger sense of national identity and commitment, fostering an America-first mentality from an economic standpoint. By investing in our citizens from birth, we are making a clear statement: we believe in the potential of each American and are committed to nurturing that potential. It’s a strategy that underscores the value of legal citizenship, while incentivizing responsible and lawful participation in the economy.

Safeguarding Social Security and Future Retirement

With Social Security under constant threat of insolvency, this policy offers a forward-thinking solution. Imagine if a portion of this $100,000 was incentivized to remain in savings or retirement accounts, reducing dependency on Social Security and allowing it to continue as a safety net for those who need it most.

This initial investment at birth could ensure that everyone has something saved for retirement, which could drastically reduce the need for Social Security benefits. By allowing these funds to grow over time and incentivizing beneficiaries to keep the money invested, we can help create a more sustainable future for Social Security and reduce the pressure on government-funded retirement programs.

Strengthening Small Business and Entrepreneurship

Beyond education and personal security, this policy could have a transformative effect on small business creation. With access to funds at 18, young entrepreneurs could choose to invest in their dreams rather than going into debt. This would likely result in an increase in startups and small businesses, which are the backbone of the American economy.

Imagine a country where every young person has the capital needed to explore entrepreneurship. This program could drive innovation, stimulate job creation, and give a new generation the ability to shape the future of our economy. By supporting small business growth, we build a stronger, more resilient economy, one driven by diverse ideas and a more inclusive range of business owners.

Addressing Birth Rates and Future Growth

Finally, this policy could encourage higher birth rates, addressing concerns about the aging population and the strain on social systems. With the promise of a financial start for every child, families may feel more financially secure in choosing to have children, leading to a more robust population growth rate. This has far-reaching implications for the economy, as a larger, younger population will help sustain growth, support the aging population, and maintain America’s competitive edge on the global stage.

Conclusion

The beauty of this proposal lies in its simplicity: a one-time $20,000 investment that grows with each child until adulthood. The potential returns are immense, not just for the individual but for society as a whole. We’d be empowering future generations with education, economic opportunity, and the financial security they need to thrive. And while the upfront cost may seem steep, the long-term benefits could fundamentally reshape America’s economic and social landscape.

An investment like this is an investment in the very foundation of America’s future. It addresses deep-seated issues like inequality and educational barriers, while simultaneously reinforcing the value of citizenship and helping to secure our country’s financial future. It’s a big idea, and with the right implementation, it could bring about a brighter, more equitable, and more prosperous future for all Americans.